With back-to-school around the corner, many parents are thinking ahead to what new schedules and daily routines will look like in the fall. Establishing chores and an allowance within this time is a great way to provide structure and opportunities to earn a little cash for extracurriculars and friend hangouts. It will also help teach your kids money management skills without them realizing it.

With back-to-school around the corner, many parents are thinking ahead to what new schedules and daily routines will look like in the fall. Establishing chores and an allowance within this time is a great way to provide structure and opportunities to earn a little cash for extracurriculars and friend hangouts. It will also help teach your kids money management skills without them realizing it.

“Setting an allowance for children at a young age will help teach them to become financially responsible,” said Lisa Wilson, AVP Branch Manager at Iowa State Bank. “It will prepare them for when the time arrives to manage their money on their own.”

6 Steps to Setting an Allowance

In today’s day and age, setting an allowance for your kids seems like an ancient tool. Many economists, however, encourage parents to set up an allowance for their kids early in life so they can learn how to manage their money and make mistakes when they’re young rather than later in their life.

Create a Plan

No one has more questions than a child. To help your child understand their allowance, think about why you want your child to have one, what they must do to receive it, the expenses they are expected to cover, and how often they receive it.

Establish an Allowance Amount

Try the age-based approach to avoid conflict and comparison if you have multiple children. This gives them the same amount of money as their age. For example, if your child is 12, their allowance is $12. Ultimately, it depends on the family and their budget, so set an amount that makes the most sense for your family.

Designate a Payday

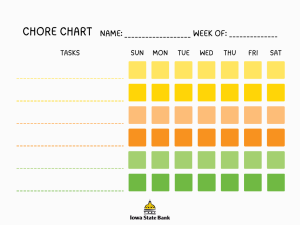

Make a note on your calendar for giving your kids their allowance and note the expected tasks you have set for your child during the week, so they are held accountable for their end of the deal. Staying consistent will build trust between you and your kids.

Implement the Three S’s (Spending, Sharing, and Saving)

To help your kids learn money management, have them split their allowance into three categories — spending, sharing, and saving. For example, suppose you are paying your child $15 a week. In that case, they can put $5 toward the spending category for something they would like to buy, $5 into sharing such as donating it, and, lastly, $5 into the savings category if they want to save up for an expensive gaming console or other high-ticket item. Putting their money into these categories will help them see money is only sometimes meant to be spent and will help them understand how to manage their bank accounts when they are adults.

Allow Them to Make Mistakes

As much as you want the best outcomes for your kids, there is no learning without failure. For your kids to learn money management, let them be independent with their allowance and have them spend and save on their own even if this deviates from the agreed upon “3 S’s” plan. Learning these lessons early on will help them in the future when they are making bigger purchases. Spending too much of their money on candy is a better lesson to be taught now than when they are older and spend too much on a car.

Avoid Making It a Punishment Tool

Do not take away their allowance as a form of punishment. Taking away their allowance can damage the trust between you and your child because it shows them you are not holding up your end of the deal. Instead, find another appropriate punishment, such as limiting how often they can see their friends or limiting their screen time.

Download this free DSM Mom Chore Chart to help get you to get started on setting tasks and savings goals for your kids. And if it’s a personal savings account you want to open for your child, Iowa State Bank is here to make it happen!

Learn More

Contact Lisa Wilson, AVP Branch Manager, Iowa State Bank (NMLS# 651247) at [email protected] or 515-223-0011 to learn more ways you can teach your kids about managing their money and information on opening their own savings account.